capital gains tax indonesia

Other income-related tax rates to keep. Gains on listed shares are taxed at 01.

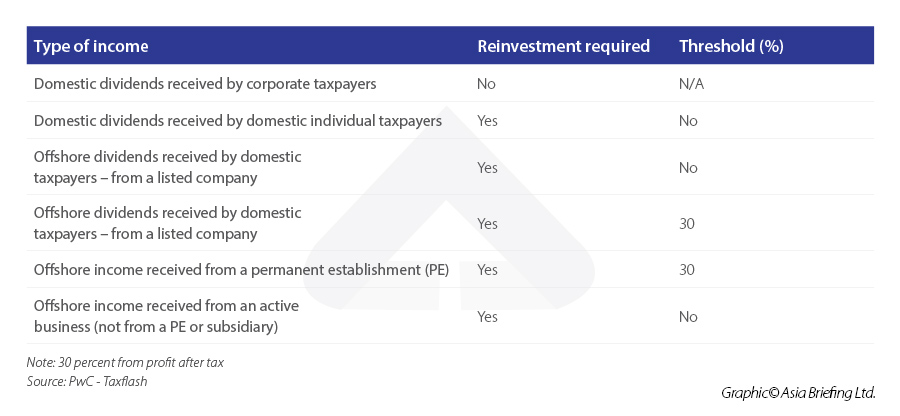

What Are The Changes In Tax Treatment Under Indonesia S Omnibus Law

Taxation in Indonesia is determined on the basis of residency.

. Residency tests are applied as follows. If these households realize 6 trillion of. Taxes on income profits and capital gains of total taxes in Indonesia was reported at 5002 in 2019 according to the World Bank collection of development indicators compiled from officially recognized sources.

Selain Capital Gain Anda Juga Bisa Mengalami Capital Loss. In arriving at effective capital gains tax rates the. Under a trade and asset sale the gain on sale proceeds including any capital gain is taxed as part of normal income at the corporate income tax rate of 22 percent a 20 percent tax rate shall apply from year 2022 onwards.

Capital gains tax CGT rates Headline corporate capital gains tax rate Capital gains are subject to the normal CIT rate except for sale of land and buildings and exchange-traded shares see Indonesias corporate tax summary for more information. The settlement and reporting of the tax due is done on self-assessed basis. However the exact rate may be increased.

The tax is 5 final tax or 25 from 8 September 2016 on the taxable. 5 rows If youre a tax non-resident20 based on gross income. The Indonesian government has expanded the tax incentives given to taxpayers that are affected by COVID-19.

Generally the VAT rate is 10 percent in Indonesia. Or - stay in Indonesia for more than 183 days in any 12-month period. If the seller is non-Indonesian tax resident the 5 capital gain tax final due on gross basis will.

A 01 final withholding tax is imposed on proceeds of sales of publicly listed shares through the Indonesian Stock Exchange. In the Philippines Colliers produces residential. Gains on disposal buildings or land are taxed at 25.

Investasi tidak selalu untung terkadang Anda juga bisa merugi. On the transfer of assets other than land and buildings 25 capital gain tax due on net basis will apply for the Indonesian tax resident seller. In arriving at effective capital gains tax rates the Global Property Guide makes the following assumptions.

Value Added Tax VAT. An additional tax at the rate of 05 of the share value is levied on sales of founder shares associated with public offerings. 44PMK032020 MOF Regulation 44 may now enjoy those tax incentives under Minister of Finance Regulation No.

2 days agoHe estimated that taxpayers subject to our proposal have unrealized gains totaling about 75 trillion in 2022. Taxes on income profits and capital gains current LCU - Indonesia International Monetary Fund Government Finance Statistics Yearbook and data files. In Indonesia the main differences among acquisitions made through a share deal versus an asset deal are as follows.

Capital gains taxes. An additional tax of 05 applies to the share value of founder shares at the time of an initial public offering. The calculations for gains taxes would defer based on the category being taxed.

In Thailand the Bank of Thailand publishes a time-series. 7 hours agoCrypto capital gains are one of four important areas of focus for the Australian Taxation Office ATO in 2022. Some taxpayers that were not entitled to tax incentives under Minister of Finance Regulation No.

Share deal Capital gains received by an entity in a share deal are subject to corporate income tax of 25 while capital gains received by an individual are subject to individual income tax in the range of 5 until 30. Capital gains taxes. 01 of gross value of the stocks transaction.

How Capital Gains Taxes in Indonesia Are Calculated. Sale of land andor buildings located in Indonesia. However sale of locally listed shares are subject to a final tax at 01 percent of gross sales proceeds and sale of domestic real estate is subject to 25 percent final income tax on the sale price.

86PMK032020 MOF. The capital gains tax in indonesia is the taxes that taxed at normal rates on the ordinary income that is derived by an individual. Based on worldwide income taxation concept overseas investment income and capital gains are treated as normal income subject to income tax.

Di tahun 2015 capital gain jangka panjang dikenakan pajak yang bermacam-macam mulai dari 0 untuk pajak penghasilan 10 dan 15 15 untuk pajak penghasilan 25 sampai 35 atau 20 untuk 396 pajak penghasilan. The same tax rate exists for corporations and individuals for capital gains. PPh Pasal 4 ayat 2 The founders share transactions additional rate is 05 of the value of the companys shares at closing of stock exchange at the end of 1996 or the stocks IPO value for the company that traded after January 1 1997.

However gains from the transfer of land and buildings are not subject to regular CIT but rather are subject to final income tax at a rate of 25 of the transaction value or the government-determined value whichever is higher. This is the final tax of the transaction value. The price difference between when an asset was purchased and when it was sold is referred to as a capital gain or loss.

Capital gains are generally assessable together with ordinary income and subject to tax at the standard CIT rate. The gains taxes are taxed at different percentages. Or - are present in Indonesia during a tax year and intending to reside in Indonesia.

- are domiciled in Indonesia. Taxation on Capital Gains and Investment Income Capital gains are generally assessable at standard income tax rates together with other income of the individual. The Australian Tax Office Has Identified Four Major Areas For Cryptocurrency Capital Gains.

5 rows 10. This is the final tax of the transaction value. Individual resident taxpayers are individuals who.

Indonesia has house price statistics and so does China both of questionable quality. However there are several exemptions. Or 15 upon election and the gains are as a.

Indonesia Plans To Tax Crypto From May Government To Levy Vat And 0 1 Tax On Income From Crypto Trade Business Insider India

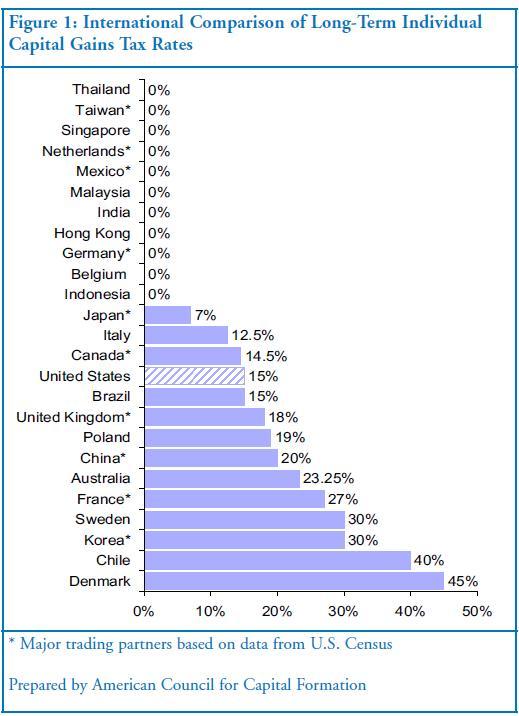

Capital Gains Tax Would Buffett Prefer To Live In Holland

Why Indonesia Should Raise The Income Tax Of The Ultra Rich Individuals

Top 8 Things To Know About Taxes For Expats In Indonesia

Doing Business In The United States Federal Tax Issues Pwc

Everything You Need To Know About Capital Gains Tax

Long Term Capital Gains Vs Short Term Capital Gains And Taxes Nasdaq

Indonesia To Impose Vat Income Tax On Crypto Assets From May Reuters

Obama Should Leave The Capital Gains Tax Rate At 15 Seeking Alpha

Indonesia Singapore Updated Double Taxation Avoidance Agreement Or Tax Treaty

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

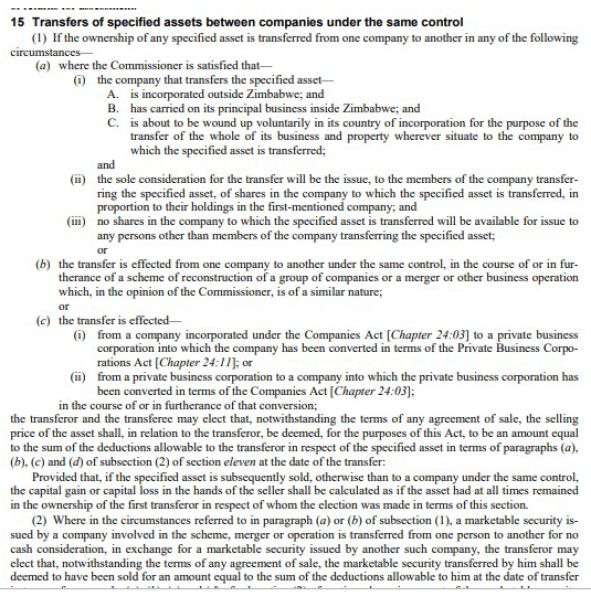

Capital Gains Tax Capital Gains Tax Zimbabwe

Capital Gains And Why They Matter A Tax Expert Explains

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

12 Ways To Beat Capital Gains Tax In The Age Of Trump

What S Your Tax Rate For Crypto Capital Gains

Indonesia To Impose Vat Income Tax On Crypto Assets From May Reuters